Chapter 8

Chapter 8: How to Get Paid as a Freelancer

Once you’ve completed your work, the next step is getting paid. Hopefully, you’ll have an appreciative client who pays promptly. First and foremost, you need to choose the best payment option. We summarize the top payment options and help you decide which is best for you. Also discussed is how to receive international payments, fees, invoicing, and (unfortunately) what to do in cases of non-payment.

Once you’ve completed your work, the next step is getting paid. Hopefully, you’ll have an appreciative client who pays promptly (and if you don’t, see our tips below).

First and foremost, you need to choose the best payment option. Here is our summary of the payment options for freelancers:

- Check. This is the traditional way to send payment long distance. Checks are easy, and in most cases, you don’t have to pay any fees to deposit them. On the other hand, you’ll have to wait for the check to arrive in the mail, and then wait for the funds to clear once it’s deposited in your account.

- Paypal. It’s the best-known online payment processing service, and it’s been around a long time. Paypal is a fast way to get your money, but you’ll have to pay fairly high fees.

- Credit card payments. Using a credit card processing service means you can accept credit card payments over the internet. It’s fast and fees are relatively low, but your client needs to feel comfortable sharing their credit card information. If this won’t be an issue for you, check out these best credit card processing companies in 2023.

- Bank wire transfer. It’s secure and reliable, and the money goes directly to your bank account. However, the fees for bank wire transfers can be $30 or more for each. Bank wire transfers can also take as long as five business days to process, especially if you’re getting paid by a client in a different country.

- Electronic funds transfer (EFT). This is a bank transfer that can be faster and cheaper than a wire transfer – but it depends on your bank. Some banks still take up to four business days and charge high fees for EFT payments.

- Accounting software with built-in payment options. Tools like Due, Wave, and QuickBooks enable you to produce and send invoices and collect electronic payment from your clients. Payment processing is secure and fast, fees are relatively low, and clients feel reassured by using a reputable payment option.

- Freelance platforms. Most freelance platforms have a built-in payment process, which accepts payment from the client on your behalf and deposits it in an attached online account. This method is secure and reliable, but you’ll have to pay varying fees for the service, and you might have restrictions on when and how you can withdraw money from your attached account.

- Built-in payment gateway on your website. If you have your own website, You can easily add an online checkout system to receive payments through the site. Online payment gateways like Payline Data, Stripe, 2Checkout, and WePay make it simple, but you need to be comfortable with the technology – and it’s only worth doing if you take a high volume of transactions each month.

- Online payment solutions. Freelancers can choose from a wide variety of solutions such as Payoneer, Cash App, Skrill, Authorize.net, ProPay, Google Pay, and more. Online payment solutions are an especially good choice if you’re getting paid by an overseas client in a different currency. You’ll pay far less in fees and get the money faster with one of these platforms. These tools also make the foreign currency conversion for you and deposit the money in your online account.

| Payment option | Advantage | Disadvantage |

| Check | No deposit fees | Takes a long time to arrive and to clear |

| PayPal | You get your money quickly | Relatively high fees |

| Credit card payment processing (e.g., Square) | Fast payment processing | Client might not be comfortable giving their credit card details |

| Bank wire transfer | Secure deposit directly to bank account | High fees |

| Electronic funds transfer (EFT) | Cheaper than wire transfer | Payments can take up to four business days to arrive |

| Accounting software with built-in payment options (e.g. Due, Wave, QuickBooks) | Integrates with your accounting software for easier tax calculations | Only relevant if you use the accounting software package |

| Freelancer platform accounts | Secure and reliable for you and your client | May face restrictions on when/how you can withdraw money to your bank account |

| Built-in payment gateway on your website (e.g., Payline Data, Stripe, 2Checkout, WePay) | Quick payment processing | You need to make a high volume of transactions each month to make it worthwhile |

| Online payment solutions (e.g., Payoneer, Cash App , Skrill, Authorize.net, ProPay, Google Pay ) | Automatic foreign currency exchange | You’ll need to open an account with your chosen payment solution |

Pro Tip: You don’t need to stick with only one payment method. However, we don’t recommend more than 2-3 options, as any more can make it confusing to stay on top of your finances. The more payment options you provide (ex: check, bank transfer, and PayPal), the more likely you are to get confused and/or overlook a payment.If you’re choosing an online payment solution, it’s best to check these points:

- Does it process your local currency or the currency in which your clients are paying you? Some payment solutions are best for certain areas because they are experts at handling that currency, such as Payoneer for Eastern Europe, Africa, Australia, and Asia, Dwolla for the U.S., and WorldPay for the U.K.

- What are the fees for processing payments in your local currency, and the currency most of your clients use?

- How long does it take to process payments for your country?

Check out this comprehensive guide to some of the most popular payment methods for freelancers.

Receiving International Payments as a Freelancer

If you have clients located in different countries who pay in different currencies, you’ll need to determine how to handle international payments. Here are three things to consider:

- What currency do you want to be paid in? You might live in Chiang Mai, but still prefer to get paid in USD to your US bank account, instead of asking for payment in Baht.

- Does your preferred payment method work in your region? For example, bank transfer might be the fastest option, but if your client in India can’t do bank transfers, you’ll have to find a different method.

- Will you have to pay foreign exchange fees? See the next section to understand what fees you might have to pay to accept an international payment, and decide which method is the most cost-effective for you.

Here are the most popular payment options for each region of the world:

| Region | Payment method |

| United States | Credit cards |

| Europe | Local or regional bank transfers |

| Japan | Credit cards or cash at Kombini |

| China | Online payment solutions (AliPay and PayEase are the most popular platforms) |

| Russian Federation | Qiwi kiosk-style payments, online payment solutions (Yandex is the most popular) |

| India | Internet bank payments |

| Asia-Pacific | Mobile payments |

| Latin America | Local and regional online payment solutions (DineroMail and MercadoPago) |

| Africa | Mobile payments |

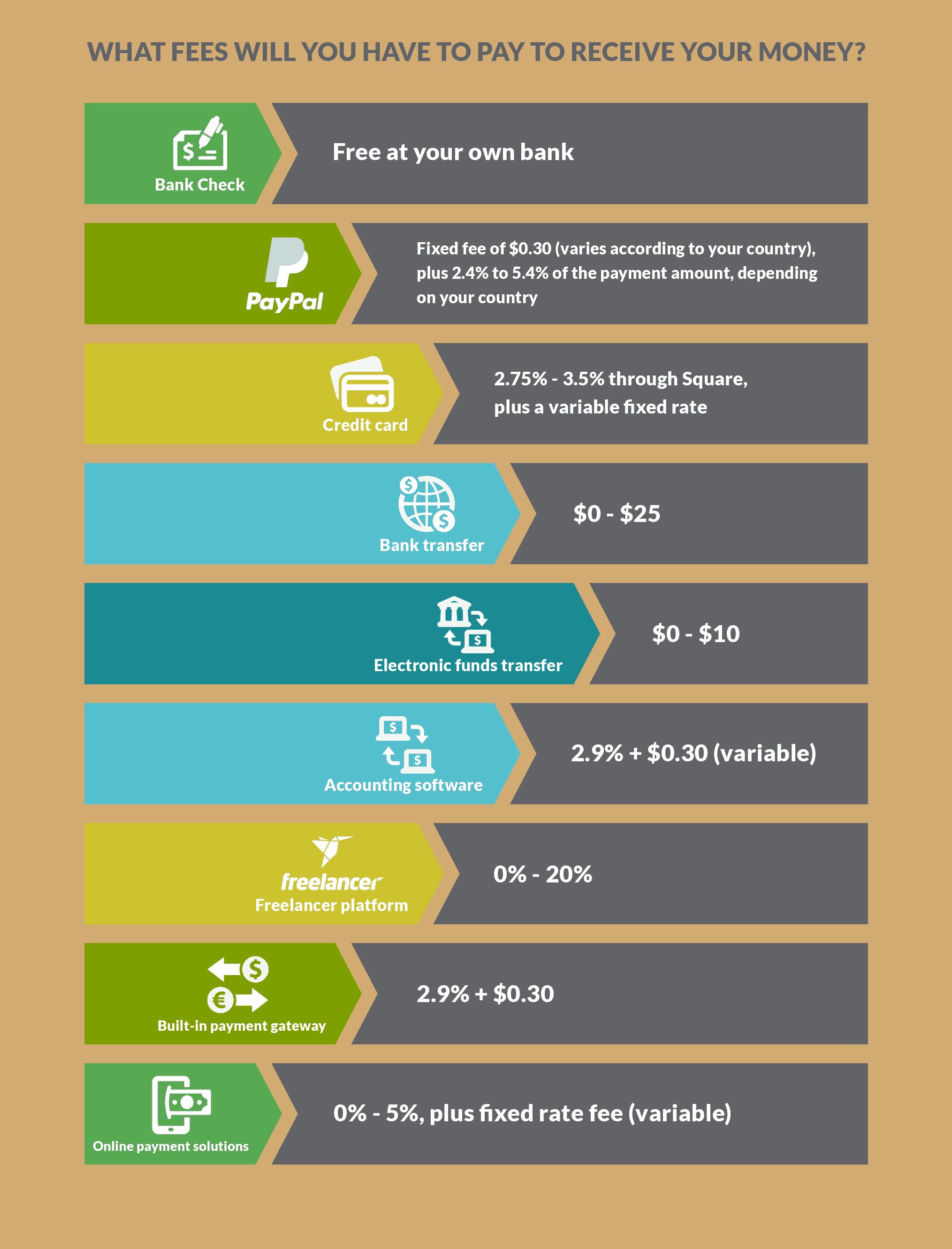

What Fees Will You Have to Pay?

Most payment options come with associated fees.

Some clients may agree to cover the payment fee for you, but that’s not something you can expect

. Some of the fees you might have to consider when you get paid as a freelancer include:

- Processing fee to receive money through your chosen payment method

- Bank fee charged by your home bank for receiving a transfer

- Foreign currency conversion fee

- Withdrawal fees for transferring money out of your online account on a freelance platform, from the payment gateway integrated into your website, or your online payment solution account

These are the fees charged by the main payment methods:

How to Get Paid in Advance

It’s a good idea to request that some of your payment be made in advance.

This is especially true for big projects

. It’s much more common to ask for advance payment for a fixed-price project, but if you’re working for an hourly rate and gave an estimate of how long the project will take, you could also ask for a portion of that estimated total cost upfront.

If you have to wait till the end of the project to get paid the entire amount, there’s a risk that the client will refuse or delay payment, or try to convince you to take a lower price. (Generally, if you work through a freelance platform, you won’t be able to ask for part of the payment in advance. This isn’t a problem, because most platforms have policies in place to protect you from losing out on payment for completed work.)

The amount to request as an advance payment depends on the size and length of the project

. Generally, freelancers ask for up to 50% of the final amount when the contract is signed, and the remaining 50% on project completion. For long-term projects (i.e. over a month long) it’s better to ask for 25% upfront, and the rest divided between checkpoints in the middle of the contract and after the project is completed.

The checkpoints you’ll set up are dependent upon your line of work and the length of the project

. If your focus is in a more creative field, such as a writer, designer, or video editor, your checkpoints will often look something like this:

- 25% upon signing the contract

- 25% – 30% upon approval of the first draft

- 45% – 50% upon completion of the project

If you’re a software or app developer or you work in some other tech-related field, you might find something like this to be more effective:

- 25% upon signing the contract

- 25% upon approval of the wireframe website/app/tool

- 25% upon design approval

- 25% upon project completion

Here’s a Note: Asking for payment in advance may seem daunting. Just remind yourself that you are giving the client the reassurance that their project is a top priority. Asking for payment upfront shows you are providing high-quality, professional services.

When Is the Best Time to Invoice for Freelance Work?

Invoicing is one of those necessary tasks that most freelancers do not enjoy – but if you want to be paid, you have no choice. It’s a lot faster and easier to process all of your invoices at the same time, instead of interrupting your work to do them one at a time.

Most freelancers prefer to invoice once a month, generally at the end of each month

. This also fits with the accounting rhythm of most businesses, which pay employees monthly.

If you’ve just finished a large project or you’ve agreed to a payment schedule that involves payments at checkpoints along the way, you won’t want to wait until the end of the month to invoice the client. In these cases, it’s best to invoice when you reach each checkpoint, whenever that may fall in the month.

For super-short projects, it can also be best to invoice straight away instead of waiting for your regular invoicing date. This way the client won’t forget about your services, and you’ll (hopefully) get the money faster.

It’s always awkward to have to chase a late-paying client. But remember that you’ve done the work, and you deserve to get paid. Here are some tips for chasing late payments:

- Anticipate the problem in advance. It’s best to add a clause into your contract for what happens if payment is late – for example, when you’ll charge a late payment fee and how the amount will be calculated.

- Start with a friendly reminder. If the payment is a week overdue, it’s time to send a polite email reminding the client they owe you money and asking for payment. Don’t wait too long to send this first reminder.

- Keep reminding the client every week until they pay up. If you get to one month overdue, it’s time to use a much harsher tone. It should go without saying that you shouldn’t do any more work for this client until they pay.

- Automate the process. Writing late payment requests is awkward, so it’s a lot easier to use a tool like Due or QuickBooks. With these tools, you can set a late payment reminder to be sent automatically.

What Do You Do if the Client Never Pays?

As awful as it sounds, most freelancers have had the experience of a client who just won’t pay, or refuses to pay the full amount. What are your options if you find yourself in this situation?

- Send a lawyer’s letter demanding that the client pays for the work you have completed. Sometimes just showing you mean business can be enough to shake your client into doing the right thing.

- Take them to court. Depending on where you live and what is written in your contract, you could take your non-paying client to court. In New York City, for instance, a new law requires clients to pay freelancers within 30 days of completion or by the stipulated date, for jobs paying $800 or more. The Freelancers’ Union is lobbying to have this law extended across the U.S.

- Write in the contract that you’ll only hand over final access to your work, or copyright will only transfer to the client, after you are paid in full. This way you have leverage over the client if they refuse to finalize payment.

- Cutting your losses is never the best option, but sometimes it’s all you can do. If it’s only a small sum, or you don’t have the necessary clauses written into your contract, or if you just don’t feel like fighting, you might choose to swallow your loss and move on.

Don’t Forget: The best way to make sure you get paid? Make sure your contract is airtight. If your contract has loopholes, or if (GASP!) you don’t have a contract that lays out payment policies and procedures, as well as consequences of non-payment, there’s always a chance you won’t get paid on time (or at all).

How Freelance Platforms Help You Get Paid

Another advantage of using a freelance platform to find work is that they can help you get paid on time. Most platforms, like

, use some form of escrow. This means that before you start work, the client has to deposit enough funds to cover the project. The platforms hold these funds as an impartial agent while you complete the project, and release them to you according to the checkpoints in your contract.

This way, you have the security of knowing that the funds are available, and the client has the reassurance of knowing that you can’t take their money and refuse to do the work. If the client cancels their funds or refuses to pay on time, most platforms have a process of mediation to help you get paid. In extreme cases, where a client unreasonably defaults on a payment, the platform will pay out in their place so that you won’t be left empty-handed.

- Determine which payment method(s) you will use with your clients.

- Decide if you want to charge a portion of your fee in advance to show a sign of good faith on both sides.

- Review your contract’s payment terms and conditions for any missing information and/or loopholes which would inhibit you from getting paid on time or at all.

Finished? 🏁

CONTINIOU TO NEXT CHAPTER